san antonio property tax rate 2019

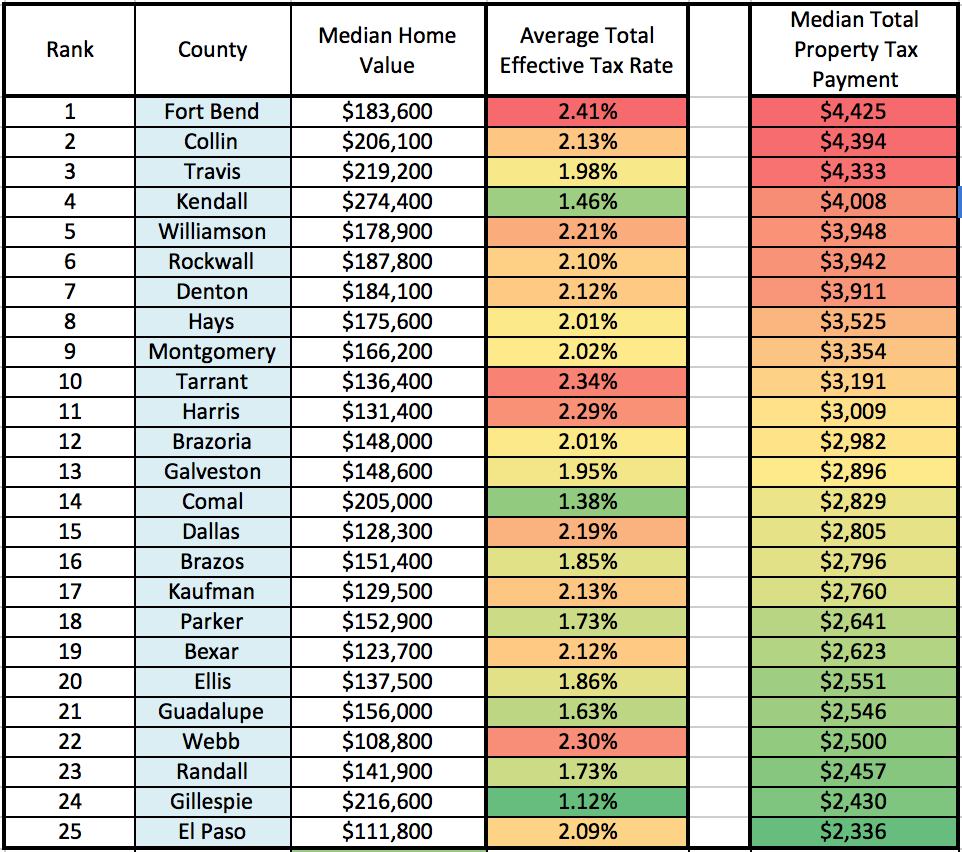

The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns. Be River Proud Kayaking Event Series.

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonios property tax collections rose an average of 53 percent per year over the past five years exceeding 35 percent in all but one of those years.

. The minimum combined 2022 sales tax rate for San Antonio Texas is. Homeowners in neighborhoods such as. China Grove which has a combined total rate of 172 percent.

San Antonio River Basin Paddling Race Series. Taxes become delinquent if not paid by the due date. The Official Tax Rate.

Median Annual Property Tax Payment Average Effective Property Tax Rate. This is the total of state county and city sales tax rates. For US citizens and residents a unified estate and gift tax is imposed.

The amount is based on the assessed value of your home and vary depending on your states property tax rate. Homeowners have to pay these fees usually on a. San Antonio River Basin Report Card 2021.

To estimate your yearly property tax in. Gorzell said those flush. Information on property tax calculations and delinquent tax collection rates.

Tax generally is imposed by the local governments at various rates. Texas has one of the highest average property tax. Tax amount varies by county.

The property tax rate for the City of San Antonio consists of two components. You can use the property tax map above to view the relative yearly property tax burden across the United States measured as percentage of home value. Property Tax Late Charges.

In Jefferson County Texas property taxes average around 1800 for homes with a median value of 101000 and a tax rate of 178 and in Williamson County Texas the property tax value is. Official Tax Rates Exemptions for each year. What is the sales tax rate in San Antonio Texas.

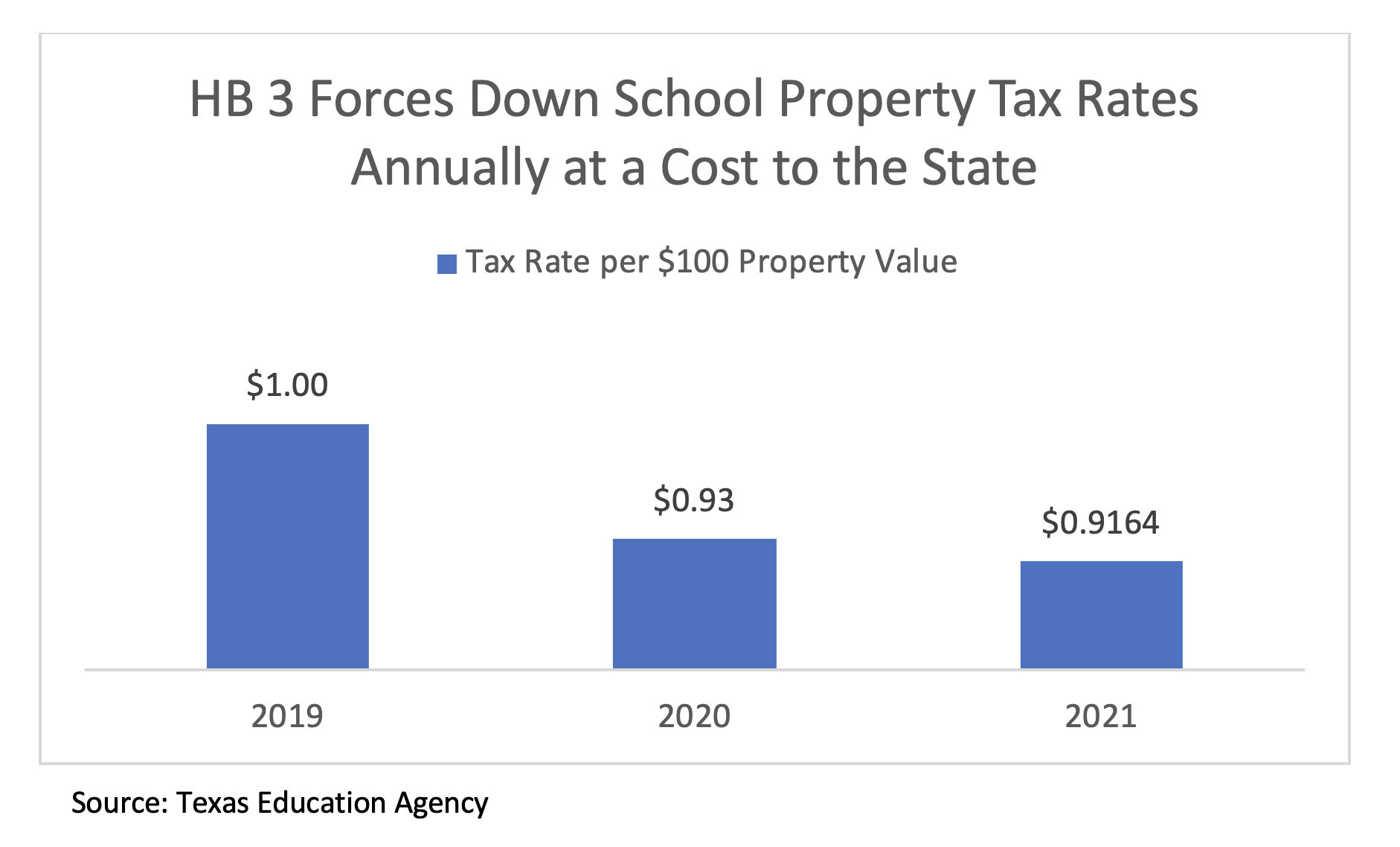

This rate is expected to reduce in 2020 but will. According to NeighborhoodScout the expected appreciation rate of the San Antonio real estate market for 2019 is 565. Maintenance Operations MO and Debt Service.

Tax statements are then sent to all property owners. The tax rate varies from. The River Authority Blog.

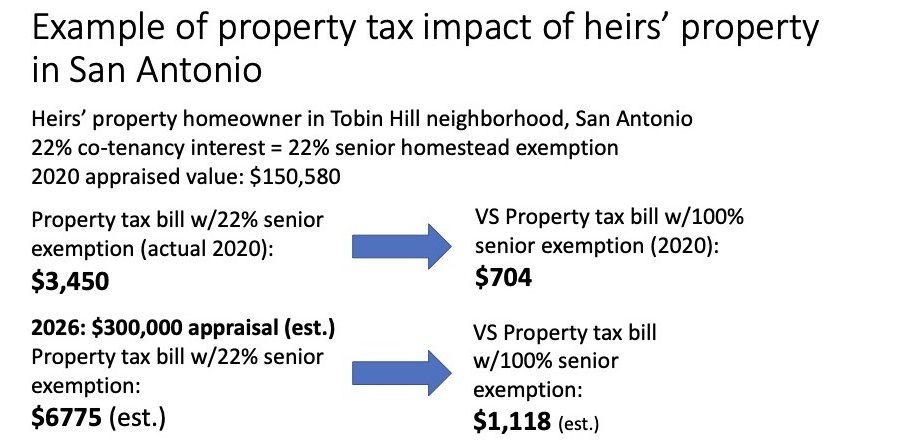

Keeping in mind that San Antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for. 79 rows When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. Rates will vary and will be posted upon arrival. A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax.

The Fiscal Year FY 2023 MO tax rate is 33011 cents. Property owners are entitled to the lower of those two measures Patel says. The Tax Assessor Collector of Bexar County applies these rates to the values of the properties within the county.

So if one property is valued at 200 per square foot and others like it are valued at 180 per square. The median property tax in Texas is 181 of a propertys assesed fair market value as property tax per year.

City Of San Antonio S Proposed Property Tax Rate For 2019 San Antonio Business Journal

How To Protest Your Property Appraisal In Bexar County

/https://static.texastribune.org/media/files/23875c51ec04b56ad1cf1eb34e8fff96/Longview%20Housing%20File%20MC%20TT%2021.jpg)

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune

A New Division In School Finance Every Texan

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tax Info Northwest Isd Bond 2021

Bexar County Commissioners Keep Hospital District Tax Rate Steady For 2021

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Tax Abatements Bexar County Tx Official Website

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Tac School Finance The Elephant In The Property Tax Equation

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tac School Property Taxes By County

Voter Approved Tax Rate Election Vatre Alamo Heights Independent School District

Is Your Property Tax Being Raised Here S How To Know

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief